Content

In case your relationship have more than one change or business activity, select on the an attached statement to help you Plan K-step 1 the level of point 179 deduction from per independent activity. The new point 1202 exception applies only to QSB stock stored from the the partnership for over 5 years. Business lovers are not eligible for the new section 1202 different. Report for every lover’s show away from area 1202 get to your Plan K-1. For each and every companion will determine when they be eligible for the fresh part 1202 exception.

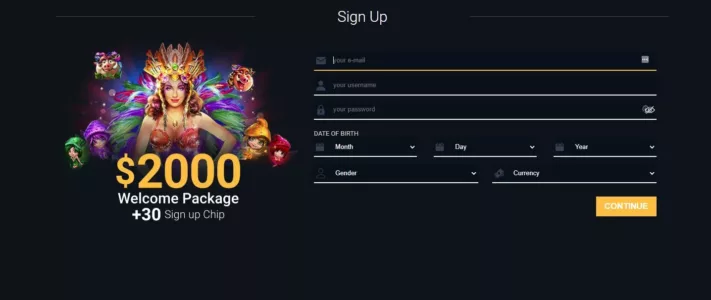

Activate The Tread Overland otherwise Powersport Equipment – casino vegas party

Simultaneously, the relationship may not subtract membership expenses in every club arranged for team, fulfillment, sport, or other social purpose. This consists of country nightclubs, tennis and sports clubs, journey and you will resorts clubs, and you may nightclubs operate to include foods lower than conditions beneficial to help you team dialogue. Enter into taxation and you may permits paid off otherwise obtain regarding the exchange or business items of your relationship if you don’t mirrored someplace else on the come back. Government import responsibilities and federal excise and you can stamp taxation is deductible only if repaid or obtain in the carrying-on the newest trade otherwise business of one’s union. Overseas fees are included online 14 as long as he or she is fees not creditable but allowable less than sections 901 and you will 903.

Relate with Yahoo Drive

The connection need dictate the new W-dos earnings and you may UBIA away from accredited property securely allocable to QBI for every licensed change otherwise organization and you will statement the new distributive show every single mate to your Statement An excellent, or a notably comparable declaration, attached to Plan K-step 1. For example the brand new pro-rata share away from W-dos wages and you may UBIA of certified assets stated to your union of people licensed trades or organizations out of an enthusiastic RPE the partnership possess individually or indirectly. However, partnerships you to very own a direct or indirect demand for a PTP may well not is people numbers to possess W-dos earnings or UBIA from accredited assets in the PTP, while the W-dos earnings and you may UBIA away from qualified assets from a good PTP aren’t invited inside the calculating the fresh W-2 salary and you will UBIA restrictions. The relationship must also have fun with Report An inside declaration for each companion’s distributive display away from QBI points, W-2 earnings, UBIA from certified possessions, qualified PTP things, and you may accredited REIT returns claimed to the partnership because of the various other entity. The partnership must report for each mate’s express from licensed pieces of income, obtain, deduction, and you can losses out of a good PTP to ensure that partners can also be determine its licensed PTP income.

- Enter on the web 14c the new partnership’s gross nonfarm income of thinking-employment.

- Right here, the newest accused try overwhelmingly females and often confronted with torture before being murdered or forced to flee.

- To help you qualify for which credit, the relationship must file Setting 8609, Low-Income Homes Credit Allowance and you will Certification, individually to your Irs.

- Examples of things advertised having fun with password Y cover anything from the next.

- Pick for the a connected declaration so you can Agenda K-step one the level of people losses which are not at the mercy of the new at-risk regulations.

Discover area 263A(i), and alter in the bookkeeping means and you can Limits to your Write-offs, later on. Mode 1065 is not considered to be a profit unless it is closed because of the a partner otherwise LLC associate. When a profit is good for a collaboration because of the a radio, trustee, or assignee, the brand new fiduciary have to indication the newest get back, instead of the mate or LLC member. Efficiency and you can forms finalized by the a receiver otherwise trustee within the personal bankruptcy on the part of a partnership must be followed by a duplicate of one’s buy otherwise guidelines of one’s legal authorizing finalizing from the newest come back otherwise mode. In the case of an entity mate, an individual who are subscribed less than condition laws to behave to own the newest organization mate need sign the connection return.

- Genetic witches inherit their magical strategies and you can life using their household.

- It focus on the significance of credibility and you may preserving the newest understanding out of their forefathers.

- Respond to “Yes” in case your union needed to make a basis protection less than section 743(b) on account of a hefty founded-inside the loss (as the discussed inside section 743(d)) or below part 734(b) on account of a hefty basis reduction (while the defined in the area 734(d)).

Because the a shareholder from an excellent RIC otherwise an excellent REIT, the connection will get see of your level of tax repaid for the undistributed money progress to your Function 2439, Find to help you Stockholder out of Undistributed A lot of time-Label Financing Development. Should your relationship invested in some other relationship that the newest provisions of point 42(j)(5) pertain, writeup on line 15a the financing advertised for the partnership inside box 15 away from Schedule K-step one (Mode 1065), code C. Enter into online 14c the newest partnership’s gross nonfarm earnings away from thinking-a career. Individual partners you would like it total figure web earnings from thinking-work within the nonfarm elective approach for the Schedule SE (Mode 1040), Part II. Go into each person partner’s express in the field 14 from Agenda K-step one playing with password C. Go into on the web 14b the fresh partnership’s disgusting farming otherwise angling money from self-a job.

Also, when you’re such diabolist details turned into influential among elite kinds, they were never extensively implemented among poorer groups away from community—and it are from the latter that impetus for casino vegas party witch examples often arose. In almost any parts of Europe, for example The united kingdomt, Denmark, Norway, and Russia, the early progressive examples reflected a carried on focus on witches not because the Demon worshipers but just since the malefactors whom cursed anybody else. The notion one to witches weren’t merely practitioners from maleficium but had been and Demon worshipers came up at the beginning of 15th century. It was very first noticeable inside samples one to happened on the western Alps inside the 1420s and you can ’30s but due much to the determine out of older facts promoted on the preceding late medieval several months.

Fundamentally, the connection must get Internal revenue service agree to changes the kind of bookkeeping accustomed statement money otherwise expenses (to have money otherwise bills total or for one matter item). To accomplish this, the relationship need to generally file Function 3115, Software for Improvement in Accounting Method, inside the income tax seasons in which the alteration try expected. A foreign connection submitting Setting 1065 solely and then make a keen election have to obtain an EIN if it does not curently have you to.

Although not, if the co-residents provide characteristics on the tenants, a collaboration can be found. In case your union makes an election below section 6418 to import a share otherwise all the part forty-eight, 48C, or 48E credits, find Other (password ZZ) lower than Line 15f. He or she is extensions away from Plan K and so are used to declaration pieces of around the world taxation significance regarding the procedure away from a partnership. Complete, Setting 1065 serves as an important tool to possess partnerships so you can report its economic things truthfully and you will meet their income tax financial obligation.

Attach a statement to form 1065 one to separately means the fresh partnership’s benefits for each away from appropriate rules C thanks to F. 526 for information regarding AGI constraints to your write-offs for charity benefits. People get or losses from Plan D (Mode 1065), range 7 otherwise 15, this is not portfolio income (such as, gain or loss from the disposition of nondepreciable personal assets put in the a trade otherwise business). For example, earnings claimed to the partnership of a REMIC, where the relationship is a recurring focus owner, was stated to your an attached declaration to own line 11.

If your union doesn’t meet with the disgusting invoices test, Mode 8990 is generally necessary. Enter into on line 7 the sum any other decreases so you can the brand new partners’ tax-foundation funding membership in the seasons perhaps not mirrored on the web 6. In addition to, if the aggregate net self-confident income out of all part 743(b) changes claimed to your Agenda K, range eleven, is actually incorporated since the an increase in order to money inside the visiting web income (loss) on the web 3, claim that amount while the a fall on the web 7.

A third use of the term witch describes a woman which is regarded as are antisocial, rebellious, or separate away from male power, a incorporate which is often working in sometimes a good misogynistic otherwise a good feminist fashion. The phrase “witchcraft” turned up having Western european colonists, along with Western european viewpoints to the witchcraft.135 That it identity was adopted by many people Local organizations to possess their own values from the hazardous magic and you may hazardous supernatural efforts. Witch hunts occurred among Christian Eu settlers in the colonial The united states plus the All of us, very infamously the newest Salem witch products in the Massachusetts. These types of products resulted in the newest execution of several someone accused from doing witchcraft. Despite changes in laws and you may viewpoints through the years, accusations away from witchcraft continuing to the 19th century in a few places, for example Tennessee, in which prosecutions occurred since the late because the 1833.

Hereditary witches really worth retaining their loved ones’s religious lifestyle while also adapting the methods for the progressive globe. Their miracle often offers deep personal and you can historic significance, rooted in familial information. Hedge witches act as mediators between the real and you may religious realms. It routine “hedge jumping,” a form of journeying otherwise traveling ranging from worlds, to achieve perception otherwise correspond with morale.

End investment account.

515, Withholding of Income tax to your Nonresident Aliens and you can International Entities, to find out more. The connection may be needed to file Form 3520, Yearly Come back to Declaration Transactions Having Foreign Trusts and you may Bill from Certain International Gifts, if any of the pursuing the pertain. Generally, the partnership could possibly deduct or even nondeductible enjoyment, entertainment, otherwise sport expenditures if your numbers try managed while the settlement to help you the fresh individual and you can claimed for the Mode W-2 to own a member of staff or on the Form 1099-NEC to have another specialist. The connection can’t deduct a price paid off or sustained to have a business (including a yacht otherwise hunting hotel) useful for an activity constantly experienced activity, enjoyment, otherwise athletics. Done and you can mount Function 4562 as long as the partnership put property in service inside the income tax year otherwise claims depreciation to the one car or other detailed assets.

It works closely which have soul books, creature totems, and you will forefathers to get into undetectable training. Due to journeying methods, such trance or drumming, shamanic witches discuss low-normal information. The traditions tend to include components of characteristics, such plants and rocks, to help you facilitate data recovery and you will sales. This type of witchcraft stresses harmony between your physical and you may spiritual areas.